Women led, impact leading.

Domini Impact Investments®

Domini Impact Investments LLC is a women-led SEC registered investment adviser that harnesses the power of finance to help create a better world. With an exclusive focus on impact investing, we aim to help drive positive outcomes for our planet and its people while seeking competitive financial returns. Our continuous innovation and caring, diverse community fuel tomorrow’s prosperity as we endeavor to make “investing for good” the way all investing is done.

Our mission.

To harness the power of finance to help build a better world.

Our vision.

We will help empower investors to better preserve the planet, inspire companies, grow multi-cultural communities, and create a world where shared prosperity is a way of life.

Our history.

1984

Amy Domini authors Ethical Investing, one of the first comprehensive discussions on incorporating environmental and social criteria into investment decision-making.

1990

Amy Domini and Steve Lydenberg help launch the Domini 400 Social Index (now the MSCI KLD 400 Social Index), the first environmentally and socially screened index.

1991

Domini Impact Equity Fund is launched as the first environmentally and socially screened index fund, tracking the Domini 400 Social Index.

1992

Domini Impact Equity Fund is one of the first mutual funds to publish its Proxy Voting Guidelines & Procedures.

1995

Domini Impact Equity Fund submits its first shareholder proposal.

1997

Domini Impact Investments LLC is founded as an SEC-registered investment adviser to centralize management of the Domini Funds.

1999

Domini Impact Equity Fund is the first U.S. mutual fund to publicly disclose its proxy voting record.

2000

Domini launches the Domini Impact Bond Fund, one of the first fixed-income funds to incorporate environmental and social standards.

2003

Domini successfully helps petition the SEC to adopt a rule requiring mutual funds to disclose their proxy voting guidelines and records.

2005

Amy Domini is named to the TIME 100, Time Magazine’s list of the world’s most influential people.

Domini first publishes its Impact Investment Standards, underscoring its commitment to transparency in communicating how it chooses its investments.

2006

Domini becomes a founding signatory to the United Nations-backed Principles for Responsible Investment (PRI).

Domini launches the Domini Impact International Equity Fund. The Domini Impact Equity Fund is converted to an actively managed strategy.

2013

During the drafting stage of the United Nations’ Sustainable Development Goals (SDGs), Domini successfully advocates for the inclusion of corporate sustainability reporting in the SDG framework.

2018

The Domini Funds become fossil-fuel free, as Domini expands its restriction on oil and gas companies to exclude the entire GICS Energy sector.

Domini formally launches its system-level investing initiative with a focus on forest stewardship.

Domini introduces an innovative new strategy for the Domini Impact Equity Fund focused on investing in peer-relative ESG leaders.

2020

Domini expands its fund lineup with the launches of the Domini Sustainable Solutions Fund, a thematic equity strategy focused on investing in solutions to sustainability challenges.

2021

Domini formalizes its commitment to advancing racial justice and diversity, both as investors and as a business, with the adoption of its Justice, Equity, Diversity, and Inclusion Plan.

2023

In its ESG Commitment Level assessment, Morningstar recognizes Domini a ‘Leader,’ one of only eight asset managers to receive this top ranking. Learn more

2024

Environmental Finance awards Domini Boutique investment manager of the year, Americas. Learn more

Our commitment.

We believe in the inherent dignity and the equal and inalienable rights of all members of the human family as the foundation of freedom, justice, and peace in the world.

We strive to take responsibility for, and where necessary, take action to address our impact on justice, equity, diversity, and inclusion across our portfolios, firm, and global community.

Our story.

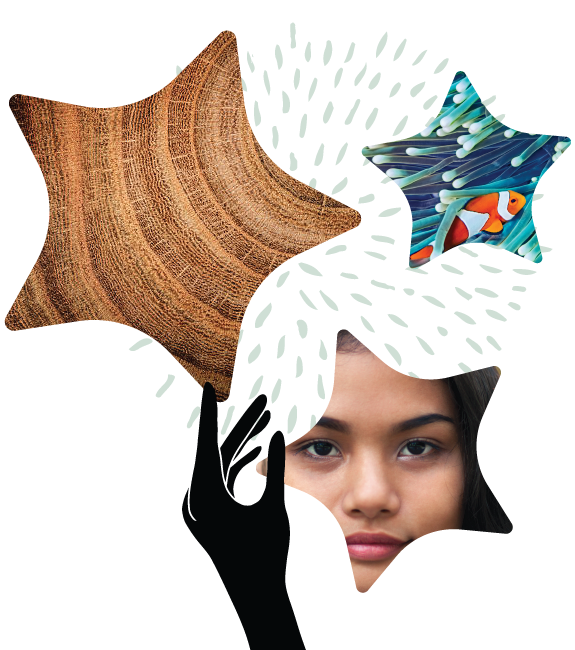

Amy Domini has told the “starfish story” in countless speeches and interviews, and the “starfish girl” has been associated with Domini since the company was founded. We find it a moving illustration of how each of us can make a positive change in the world, wherever we may find ourselves.

Thousands of starfish that washed ashore.

A little girl began throwing them in the water so they wouldn’t die. “Don’t bother, dear,” her mother said, “it won’t make a difference.”

The girl stopped for a moment and looked at the starfish in her hand. “It will make a difference to this one.”

Our values.

At Domini, we CARE. We’re committed, all-encompassing, responsible, and empowering.

Committed

Guided by our mission, we do everything with a deep sense of pride, passion, and purpose.

All-encompassing

Our view is holistic; our vision is far-reaching.

Responsible

We are conscientious, ethical, and fair. We respect differences and embrace diversity.

Empowering

We enable and inspire investors, employees, peers, partners, and communities.

1 The Global Industry Classification Standard (“GICS”) was developed by and is the exclusive property and a service mark of MSCI Inc. (“MSCI”) and Standard & Poor’s, a division of The McGraw-Hill Companies, Inc. (“S&P”) and is licensed for use by Domini Impact Investments. Neither MSCI, S&P nor any third party involved in making or compiling the GICS or any GICS classifications makes any express or implied warranties or representations with respect to such standard or classification nor shall any such party have any liability therefrom.