Impact Update

First Quarter 2024

Moving Climate Justice Forward

Finding and adopting sustainable solutions to help mitigate climate change needs to be a collaborative and collective effort.

As impact investors, part of our work consists of evaluating how companies are undertaking the climate transition. We look closely at their consideration of, for instance, physical climate risks, governance, and capital allocation. Not all industries face the same challenges. Some of the most carbon intensive industries must make considerable adaptations to their businesses to better protect the environment and people at this critical time in history.

Equally important is how this ‘green transition’ translates for companies’ workforce and the local communities they depend on. Companies must treat workers and people fairly and equitably, providing safe and healthy working conditions and training for green jobs. This is called the ‘just transition’ and, more broadly, ‘climate justice.’ Read this issue to learn more about these important topics.

Domini is proud to be designated an ESG ‘Leader’ by Morningstar in their ESG Commitment Level for Asset Managers assessment. In the 5th edition, dated 02/01/2024, we were selected as one of only eight asset managers out of 97 firms assessed globally.

The Domini International Opportunities Fund Investor Shares (RISEX) received ★★★★ Overall Morningstar Rating™ in the Foreign Large Growth Category as of 3/31/24, based on its three-year rating among 383 funds. Learn more about the Fund and methodology.

In this edition

Ensuring Affordability in the Low- Carbon Transition

Upholding Human Rights Protections in the Renewable Energy Supply Chain

Prioritizing Decent Work and Heat Stress Protection for Farmworkers

Supporting Community Protection as Mining Demand Grows

Engagement Overview

Domini meets with company executives on its own and in collaboration with other investors to encourage stronger policies and practices on the issues that matter to us. In alignment with our standards, we seek improved disclosure, more responsible practices, and address emerging issues with our companies. Through constructive interaction – via letters, dialogues, shareholder proposals, and proxy votes – Domini communicates its expectations to companies and encourages innovation and business models that uphold respect for human rights while contributing to ecological sustainability and resilience.

The UN Sustainable Goals (SDGs)

In the seven years since United Nations member states adopted the 2030 Agenda for Sustainable Development, the Sustainable Development Goals (SDGs) have been widely embraced by governments, civil society organizations, companies, and investors. The SDGs aim to address broad global topics such as poverty eradication, food security, protection of forests, sustainable cities and economic growth, gender equality, and climate change.

In each impact update, we’ll feature a few of our engagements alongside an investment highlight and show you which SDGs these are aligned with. Read more on the UN SDGs

Ensuring Affordability in the Low-Carbon Transition

Data shows that the energy burden, which is the percentage of income spent by a household on home energy bills, is three times higher for low-income households than that of higher-income households. This can be due to several factors, including lower energy efficiency, older homes, or higher fuel costs.

In our ongoing engagement with the utility company, National Grid, we are encouraged that their work is underway on a “fair transition” strategy. This includes a series of listening sessions with advocates and customers to hear their perspectives and concerns. In a recent engagement, we encouraged them to align this strategy with international just transition frameworks. We also urged them to build trust with stakeholders and show how they are using the feedback they received to improve their programs. This is especially true regarding the energy burden and affordability. For example, they recently proposed rate increases in New York that would have substantially increased monthly bills. While we don’t want to slow the pace as companies make the essential transition from fossil fuels toward full electrification, we encourage them to ensure this doesn’t increase costs for low-income customers.

Investment Highlight: Domini International Opportunities Fund and Domini Impact Equity Fund

SSE is a British company that generates, transmits, distributes, and supplies electricity. In 2022 and 2023, on-shore and off-shore wind power accounted for 22.85% of its electricity generation’s output and 34.5% of its renewable generation’s total output. The company updated its Just Transition Strategy measuring its progress in areas that now include a skills-based pay progression approach, inclusive hiring practices, and re-training programs for workers a to switch to low-carbon jobs. The company’s Airtricity program offers customers reduced tariffs, price freezes, and support funds.

Upholding Human Rights Protections in the Renewable Energy Supply Chain

We are co-leading, along with PRI Advance, a collaborative human rights engagement with Siemens Energy, focused on its renewable energy subsidiary. Onshore and offshore wind turbine development and installation are important for supporting the energy transition away from fossil fuels. In the U.S., 10% of energy was generated by wind power in 2022. Manufacturing wind turbines and magnets that help them function requires raw materials, such as rare earth minerals. These materials have extensive supply chains, and further processing might present health and safety risks, challenges around freedom of association and collective bargaining, or discrimination.

In a recent engagement, we focused on learning more about how Siemens Energy oversees and reduces these human rights risks in its supply chain. Through this conversation, we were able to better understand the geographies at higher risk, what their buyers look for in the human rights practices of their suppliers, and the controls and oversight the company uses to help support a more responsible supply chain.

Investment Highlight: Domini International Impact Equity Fund

BMW, the German automaker, has increased its electrified vehicle deliveries and implemented new plans and programs for a more sustainable supply chain. In 2022, BMW had 468 agreements with its suppliers on carbon-reducing measures and required new carbon intensive suppliers to use green energy. It also concluded green electricity-related framework agreements with 46 of its largest suppliers. The company uses standardized tools provided by the Responsible Minerals Initiative (RMI) to ensure its raw materials are traceable to the smelting factory or refinery.

Prioritizing Decent Work and Heat Stress Protection for Farmworkers

Farmworkers who spend every day working in fields are a good example of a community already experiencing the impacts of climate change. As temperatures increase, their work becomes more dangerous, with growing numbers of workers facing heat stress and associated chronic illness. For farmworkers, adapting to climate change means ensuring they have protection to keep them safe in spite of extreme heat and changing weather.

The Fair Food Program, a worker-driven social respon-sibility program designed, by workers for workers, was nimbly adapted by workers as they felt the negative effects of heat at work. They now call for more frequent breaks, shade and water access, and train workers on the signs of heat stress. In addition, many farmworkers are already vulnerable and face risks of forced labor, child labor, and retaliation for speaking out or related to their immigration status. These mandatory protections help keep workers safe and ensure the resilience of the food supply. That’s why we filed a shareholder proposal with grocery chain, Kroger, on just transition. We asked them how they protect the agricultural workers who grow the food they sell in their supermarkets from the impacts of climate change. When we see practices that are effective at protecting workers, like the Fair Food Program, we continue to encourage companies to join or show us that their approaches are as effective.

Investment Highlight: Domini Impact Equity Fund

PepsiCo’s Environmental Health and Safety Policy Strategy, “beyond zero,” aims to provide an injury-free environment to its employees. As an overlay of the program, the firm’s risk management system is designed to reduce and prevent environmental incidents and occupational injuries through internal and external audits, emphasizing technology. It invests in improving posture behavior and utilizing virtual design review and augmented reality to conduct risk assessments for machine safety. These workplace safety efforts are reducing Pepsi’s Total Global Lost Time Incident Rate (LTIR), which decreased by 8% between 2018 and 2022.

Supporting Protection of Communities as Mining Demand Grows

The low-carbon transition makes the availability of lithium, cobalt, copper, and nickel more important to ensure that the critical materials required for electric vehicles, solar panels, batteries, and wind turbines are readily available. But an increase in mining can create challenges, as it is often linked to environmental harm, water pollution, and conflict with communities. For example, research shows that 54% of transition minerals are located on or near Indigenous land. We’ve engaged with mining companies Fortescue and Norsk Hydro to better understand their human rights programs, with a particular focus on how they engage with communities. For example, Norsk Hydro has a legacy water contamination incident associated with refining in Brazil that polluted waterways and caused health problems in the community.

In dialogue, we tried to better understand how Norsk Hydro has learned from this incident to improve their outreach and consultation approach with communities, help reduce future opposition to projects, and ensure that people know how to use the channels they have available to submit complaints, including access to professional translation services. These effective grievance mechanisms are part of a company’s responsibilities under the UN Guiding Principles on Business and Human Rights.

Investment Highlight: Domini International Opportunities Fund

IGO Ltd has shown a conscious effort towards environmental management and sustainability in the mining sector through mitigation and adaptation in its business practices. This Australian firm specializes in metals critical for clean energy, prioritizing environmental stewardship, transparency, and community engagement. IGO achieved a commendable 16% reduction in Scope 1 and Scope 2 emissions in 2022 compared to the 2019 baseline. To better understand its potential impact on flora and fauna, the company conducts comprehensive field surveys, further broadening them to measure its goal of contributing to local biodiversity.

Protecting Indigenous Rights and Forestry

Inversiones CMPC SA is one of the world’s largest producers of pulp, tissue, paper, and forest and packaging products and sources from sustainably managed forests in Chile, Brazil, and Argentina. It has positive sustainability commitments, including not harvesting trees from native forests. It uses Forest Stewardship Council (FSC) certifications to help ensure certain practices around harvesting and replanting are carried out to protect the forests. However, we recently initiated an engagement to better understand concerns about the way they manage their eucalyptus and other exotic tree plantations, which may reduce biodiversity and increase the risks of forest fires. As part of our expectations around human rights, we encourage companies like Inversiones CMPC to respect the rights of Indigenous Peoples to give or withhold Free, Prior, and Informed Consent (FPIC) related to projects that may impact their rights or land. Through engagement, we hope to share these expectations and better understand how the firm’s human rights policy is implemented, particularly related to allegations that the company was connected to land grabs, displacement, and territorial disputes with the Indigenous Mapuche communities.

Investment Highlight: Domini Impact Bond Fund

The Nature Conservancy is a District of Columbia nonprofit public charity whose mission is to conserve lands and waters. Its focus areas include climate change mitigation, sustainable food and water access, and urban development. By 2030, it aims to reduce or store three gigatons of CO2 emissions annually, benefiting 100 million people who are most vulnerable to climate-related emergencies. Nature Conservancy plans to do so by protecting and restoring the health of natural habitats that protect communities from extreme weather and sea level rise, conserving ocean and land areas, preserving rivers, and supporting livelihoods dependent on healthy land and water ecosystems.

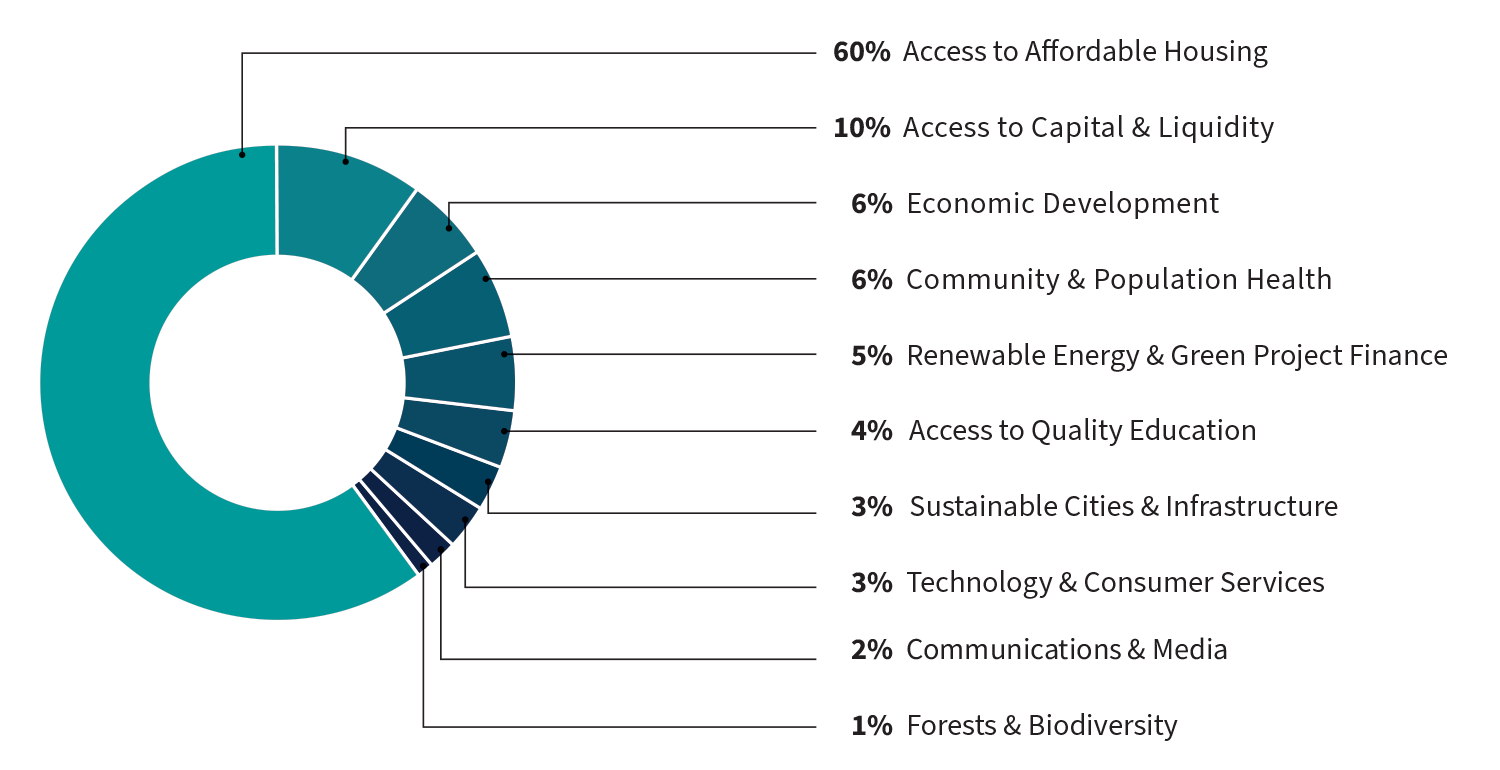

Domini Impact Bond Fund Theme Allocations*

* Based on portfolio holdings as of 3/31/2024, excluding cash & cash equivalents, cash offsets, futures, swaps and options with the exception of short-term U.S. Agency bonds and Certificates of Deposit, which are reflected in this reporting. Numbers may not sum to totals due to rounding. The composition of the Fund’s portfolio is subject to change. Visit domini.com to view the most current list of the Fund’s holdings.

The SEC’s Rule on Company Climate Disclosure and Why It Is Important

By Lionella Pezza, Director of Impact Research

In March, the Security and Exchange Commission (SEC), an independent agency of the U.S. Federal Government overseeing the country’s financial markets, adopted a final rule requiring companies to disclose certain climate-related information. In early April, due to pending legal challenges, this new climate rule was unfortunately paused by the SEC. Despite this setback, we hope that the courts will move swiftly and that the rule will be implemented without considerable delay.

The climate disclosure rule pertains to, among other things, material climate-related risks, strategies and activities to mitigate or adapt to them, board of directors’ oversight, and the role of management in managing material risks. Additionally, the rule requires several disclosures to facilitate investors’ assessment of companies’ climate-related risks, including Scope 1 and Scope 2 greenhouse gas emissions (GHGs), which are the direct emissions from owned or controlled sources, and indirect emissions from purchased energy, respectively. Large companies must start disclosing in 2025, while smaller companies will start in 2026 and 2027.

Before finalizing the rule, the SEC allowed the public to submit feedback and comments about the pending rule. Domini submitted a comment explaining why we supported the disclosure rule and how the information would be integrated into our research process, engagement and dialogue with companies, and proxy voting work. We were pleased that the SEC referenced our comment 13 times in the final rule.

It is difficult not to overemphasize the historical significance of this new mandatory rule. It is a paradigm shift and an acknowledgment that climate change is a risk that companies can no longer ignore. It’s clear that they can’t continue to operate under a “business as usual” scenario. It is a material risk, ensuring its relevance to how an investor makes its decision.

Companies will now be required to measure and manage their climate risks through disclosure of targets and goals with annual updates on their progress. The rule requires companies to disclose if they have activities to mitigate or adapt to climate-related risk and if they use transition plans, scenario analysis, and carbon prices to do so and disclose their progress to investors.

Thanks to the new rule, the U.S. has joined the EU and global disclosure frameworks, such as the International Sustainability Standards Board (ISSB), in an effort to push for better climate disclosure across the globe.

The final rule adopted in March was a compromise among many parties. Some elements we hoped to see in the rule were omitted. One of the most prominent omissions was Scope 3 emissions, which are those that are not directly emitted by the company and are not the result of activities from assets owned by the company but are generated as a result of their product or service. It is our perspective that a company is indirectly responsible for this type of emissions through its value chain, such as supply chain inputs and the use and disposal of products. We think that it is essential for companies to track these emissions and take meaningful steps to reduce them. Even though the rule does not include all of the elements we were hoping for, it is a significant step in the right direction in addressing one of the most pressing challenges of our time.

Domini’s work does not end here. Through our direct dialogue with our portfolio companies, we will continue to ask companies for voluntary disclosure of Scope 3 emissions and for better and continuously improved disclosures. At the advocacy level, we will continue to make our voices heard and push for regulations that will help protect the environment for future generations.

Domini News

At Domini, we seek to harness the power of finance to create a better world. From innovative approaches to the role of investors in addressing nature and biodiversity loss, we cover a range of topics that highlight the intersection of finance and environmental stewardship.

Highlights from our ESG Research: Crafting Flavors and Fragrances

In the ever-evolving landscape of the flavor and fragrance industry, one prominent critical concern stands out—the impact on biodiversity. While the industry has long been associated with sensory experiences, the quest for unique flavors and captivating fragrances has led to significant repercussions in the world’s ecosystems. Read about a company that’s making strides to help protect nature and biodiversity. Read more at domini.com/fragrances

Back to Nature – an essay by Amy Domini

In this timeless essay, Domini’s founder shares some of her personal memories about the virtues of spending time in nature. It is a strong reminder that companies and consumers hold a responsibility to safeguard nature and biodiversity. She shares her thoughts on what we need to do to get this done. Read more at domini.com/nature

Domini Meets NY Crowd for a Discussion on Climate Change & Impact Investing

In late March, we hosted an event at the Impact Hub NY for people interested in the intersection between climate change and investing for good. Our guest, Dr. Kevin Reed, climate expert and Associate Professor at Stony Brook University, broke down the underlying factors of extreme weather and what its effects may look like in New York. We also discussed how sustainable investing, investors, and individuals have a role to play in taking serious steps to help mitigate climate change.